The Norinchukin Bank’s Initiatives to the Equator Principles

The Equator Principles is a risk management framework, adopted by the financial institutions, for determining, assessing and managing environmental and social risk in the projects. It primarily intends to provide a minimum standard for due diligence and monitoring to support the responsible risk decision-making.

Based on the increasing public awareness of environmental and social issues and society’s expectations to the financial institutions, the Bank adopted the Equator Principles in May 2017 from the viewpoint of realizing a higher level of consideration toward the sustainable maintenance of the environment.

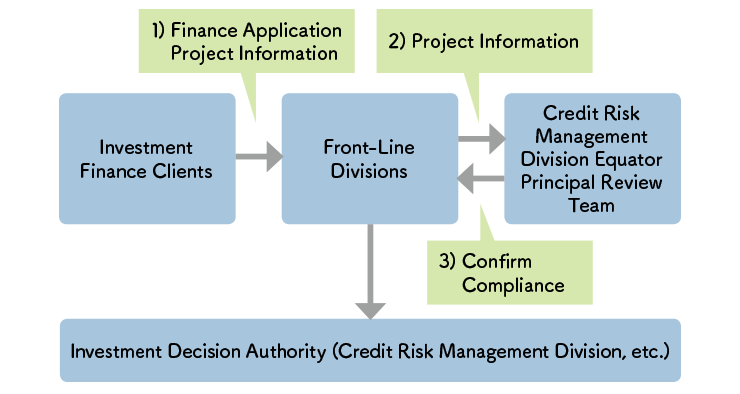

Specifically, based on the Basic Policy on Finance, the Bank has formulated the Basic Policy Regarding the Equator Principles and the Administration Guidelines for the Equator Principles, and has deployed the staffs dedicated to verifying the eligibility of applying projects according to the Equator Principles. The Bank continues to request the customers to address environmental and social considerations at the required level according to the project category.

Environmental and Social Risk Assessment process

Definition of project category

| Category | Definition |

|---|---|

|

A |

Projects with potential significant adverse environmental and social risks and/or impacts that are diverse, irreversible or unprecedented |

|

B |

Projects with potential limited adverse environmental and social risks and/or impacts that are few in number, generally site-specific, largely reversible and readily addressed through mitigation measures |

|

C |

Projects with minimal or no adverse environmental and social risks and/or impacts |

Financed transactions in accordance with Equator Principles in FY 2019

(From 1 April 2019 to 31 March 2020)

<Project Finance>

| By Secter | A | B | C |

|---|---|---|---|

|

Mining |

0 |

0 |

0 |

|

Infrastructure |

1 |

2 |

1 |

|

Oil and Gas |

0 |

0 |

0 |

|

Power |

0 |

3 |

4 |

|

Other |

0 |

2 |

0 |

|

Total |

1 |

7 |

5 |

| By Region | A | B | C |

|---|---|---|---|

|

Americas |

0 |

0 |

0 |

|

Europe, |

1 |

6 |

0 |

|

Asia |

0 |

1 |

5 |

|

Total |

1 |

7 |

5 |

| Designated and Non-Designated Countries | A | B | C |

|---|---|---|---|

|

Designated Countries |

0 |

4 |

5 |

|

Non-Designated Countries |

1 |

3 |

0 |

|

Total |

1 |

7 |

5 |

| Independent Review | A | B | C |

|---|---|---|---|

|

Yes |

1 |

7 |

5 |

|

No |

0 |

0 |

0 |

|

Total |

1 |

7 |

5 |

<Project-Related Corporate Loans>

| By Secter | A | B | C |

|---|---|---|---|

|

Mining |

0 |

0 |

0 |

|

Infrastructure |

0 |

0 |

0 |

|

Oil and Gas |

0 |

1 |

0 |

|

Power |

0 |

0 |

0 |

|

Other |

0 |

0 |

0 |

|

Total |

0 |

1 |

0 |

| By Region | A | B | C |

|---|---|---|---|

|

Americas |

0 |

0 |

0 |

|

Europe, |

0 |

0 |

0 |

|

Asia |

0 |

1 |

0 |

|

Total |

0 |

1 |

0 |

| Designated and Non-Designated Countries | A | B | C |

|---|---|---|---|

|

Designated Countries |

0 |

0 |

0 |

|

Non-Designated Countries |

0 |

1 |

0 |

|

Total |

0 |

1 |

0 |

| Independent Review | A | B | C |

|---|---|---|---|

|

Yes |

0 |

1 |

0 |

|

No |

0 |

0 |

0 |

|

Total |

0 |

1 |

0 |

<Project Finance Advisory Services and Bridge Loans>

No transactions in FY 2019.

- About The Norinchukin Bank

- Message from the Management

- The Basic Mission of The Norinchukin Bank

- Our Businesses

- Medium-Term Vision

- Our History

- Brand Message

- Corporate Outline

- Organization Diagram

- Management

- Code of Ethics

- Corporate Governance

- Global Network

- List of Group Companies

- UK Modern Slavery Act 2015 Transparency Statement

- The Equator Principles